Private equity funds are pools of capital to be invested in companies that represent an opportunity for a high rate of return. They come with a fixed investment horizon, typically ranging from four to seven years, at which point the PE firm hopes to profitably exit the investment. Exit strategies include IPOs and sale of the business to another private equity firm or strategic buyer.

Institutional funds and accredited investors usually make up the primary sources of private equity funds, as they can provide substantial capital for extended periods of time. A team of investment professionals from a particular PE firm raises and manages the funds.

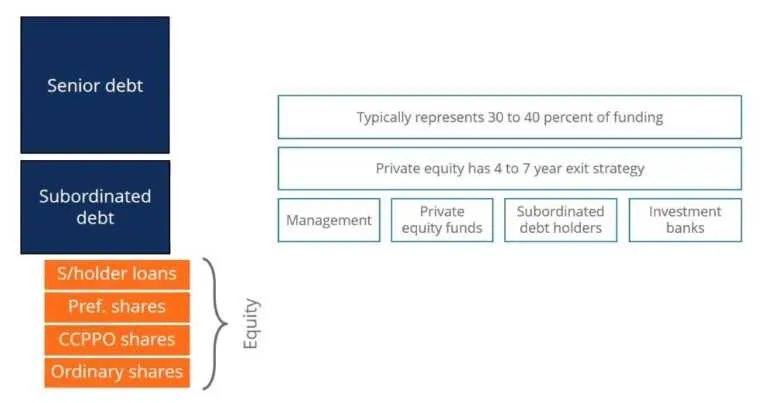

Equity can be further subdivided into four components: shareholder loans, preferred shares, CCPPO shares, and ordinary shares.

Typically, the equity proportion accounts for 30% to 40% of funding in a buyout. Private equity firms tend to invest in the equity stake with an exit plan of 4 to 7 years. Sources of equity funding include management, private equity funds, subordinated debt holders, and investment banks. In most cases, the equity fraction is comprised of a combination of all these sources.