There are several different types of bonds available under the banner of thematic bonds (Figure 1). These include, but are not limited to, green, social, sustainable, and SDG bonds. Within these categories there are sub-categories. For example, green bonds include climate bonds linked to climate mitigation, such as projects in solar and wind technologies that reduce GHG emissions, and climate adaptation, such as infrastructure projects to protect against flooding. At the same time, other types of thematic bonds have emerged in response to new challenges.

Thematic bonds are fixed-income securities issued to finance specific investment themes which target specific SDGs, such as climate change, health, food, education, and access to financial services.3,4 They benefit both investors and issuers in the market:

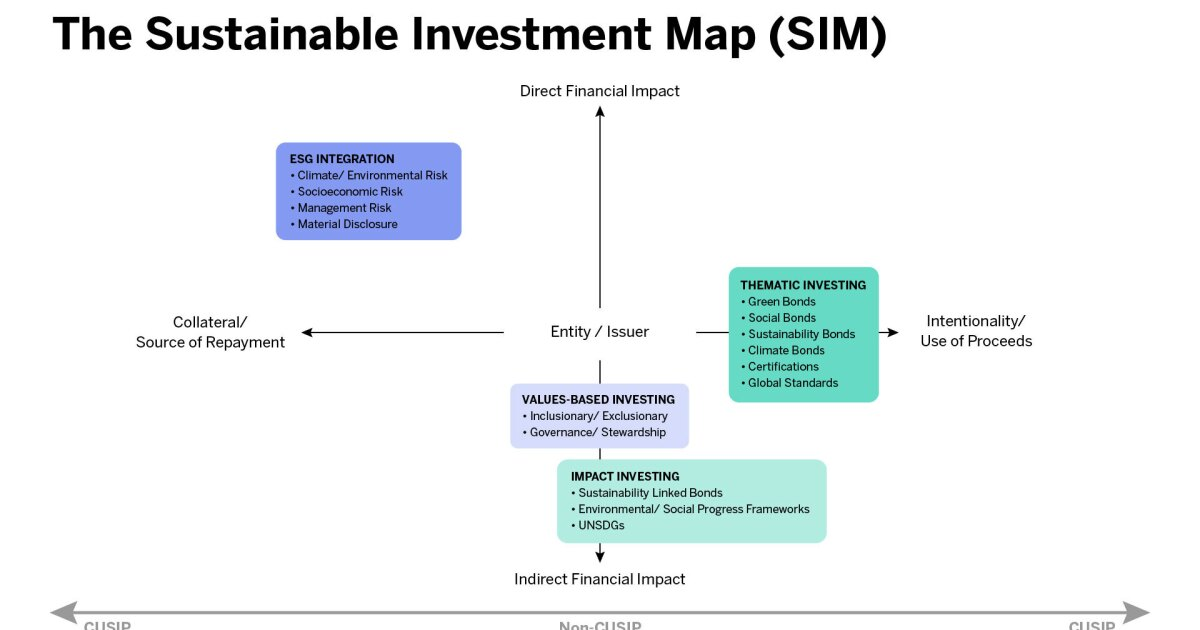

Broadly, thematic bonds are classified into two types: use of proceeds (UoP) and key performance indicator (KPI) bonds.4 UoP bonds are securities earmarked for specific projects designed to generate the intended impacts.4 KPI bonds are required to meet the overarching goals of sustainability and environmental, social, and governance (ESG) objectives but are not tied to any project or specified output like UoP bonds. Moreover, a borrower would generally have to pay higher coupon rates if the KPIs are not met.